Principal 401k withdrawal calculator

As an example we will enter 100000 as the account balance. If you return the cash to your IRA within 3 years you will not owe the tax payment.

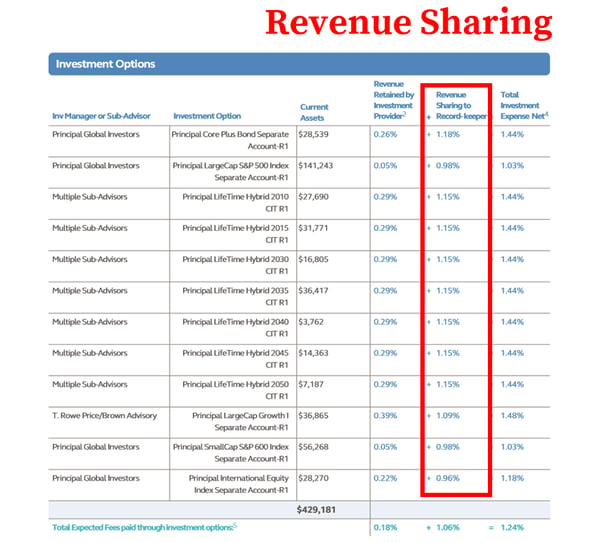

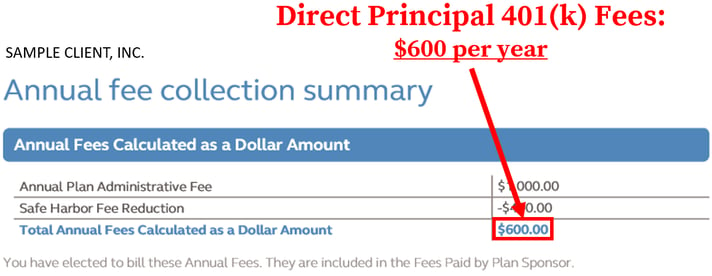

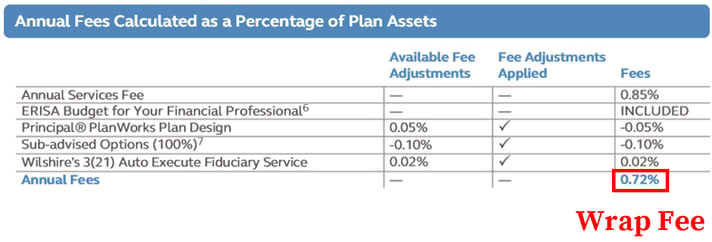

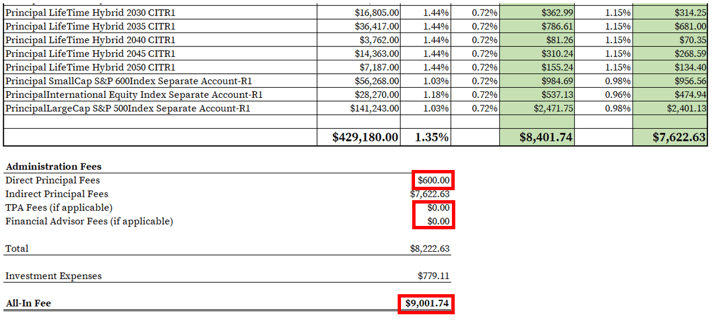

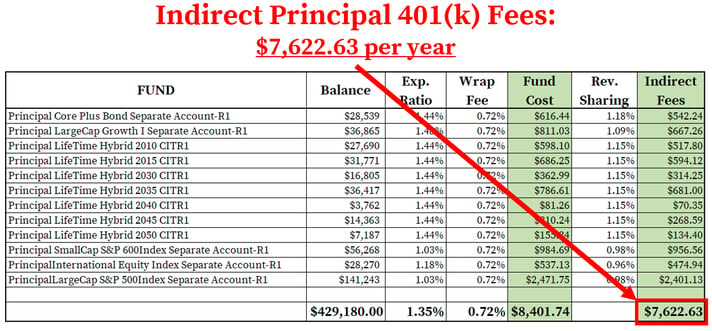

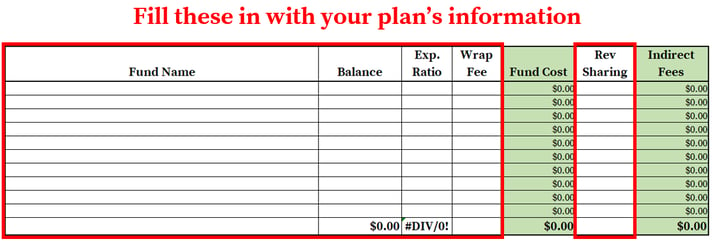

How To Find Calculate Principal 401 K Fees

All payment figures balances and interest figures are estimates based on the data you provided in the specifications that are despite.

. Taking a loan from your 401k or borrowing from your retirement plan may seem like a good option but it can hurt you in the long run. Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. It may be tempting to pull money out of your 401k to cover a financial gap.

This calculator only provides education which may be helpful in making personal financial decisions. If your employer does not offer 401k loans they may still offer a 401k withdrawal. Including the amount of the cash withdrawal from your retirement plan.

Early Withdrawal Calculator. Individual results will vary. However youll be required to repay the loan with interest or the outstanding balance will be treated as an early distribution and taxed.

Systematic withdrawals keep your principal invested through the whole period of your expected retirement. Participants should regularly review their savings progress and post-retirement needs. Because withdrawals are taxed on a last in first out LIFO basis for a non-qualified annuity purchased after Aug.

Another benefit of rolling over IRA assets to a 401k is the potential ability to borrow money from your retirement savings without triggering the taxes and penalties associated with an early withdrawal. Use our 401k Early Withdrawal Costs Calculator first. But do you know the true cost.

Early 401k withdrawals will result in a penalty. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Some fields are incomplete or the information is incorrect.

Early Withdrawal Costs Calculator. This includes direct contribution plans such as 401k 403b 457b plans and IRAs. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your 401k.

For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a principal residence is. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. The RMD waiver is for retirement plans and accounts for 2020.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. 13 1982 earnings are paid out before principal. Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Most annuity contracts allow the withdrawal of a portion of the account value each year without incurring a surrender charge. You should consider the retirement withdrawal calculator as a model for financial approximation.

The older you get. Such as a 401k 403b or governmental 457b. If you left your employer in.

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Whether youve reached retirement age or need to tap your 401k early to pay for an unexpected expense there are various ways to withdraw money from. The CARES Act of 2020 provided a temporary waiver of RMDs.

With its principal place of business in New York NY. Its California Certificate of Authority number is 3092. Responsibility for those decisions is assumed by the participant not the plan sponsor and not by any member of Principal.

401K and other retirement plans. The 401k has become a staple of retirement planning in the US. The withdrawal factor is the number that your accounts overall value is divided by to reach the minimum distribution amount.

Millions of Americans contribute to their 401k plans with the goal of having enough money to retire comfortably when the time comes. With that said however there are exceptions. Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash.

How To Find Calculate Principal 401 K Fees

Introducing Simply Retirement By Principal Ubiquity

Bond Price Finance Apps Tax App Financial Calculator

How To Find Calculate Principal 401 K Fees

2

Catch Up Contributions How Do They Work Principal

After Tax 401 K Contributions Retirement Benefits Fidelity

How To Find Calculate Principal 401 K Fees

2sgijz13wg V1m

Why Paying 401 K Loan Interest To Yourself Is A Bad Investment

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

How To Find Calculate Principal 401 K Fees

Making A Choice For Your 401 K Principal

How To Find Calculate Principal 401 K Fees

:max_bytes(150000):strip_icc():gifv()/Principal_edit-7384a3492a48477e81cd002d2bc4b0ba.jpg)

Principal Life Insurance Review 2022

Making A Choice For Your 401 K Principal

How To Find Calculate Principal 401 K Fees